Reverse Stock Split May 2022

Frequently Asked Questions

What is the reverse stock split operation?

On May 23, 2022, Saipem’s common shares were merged together in the ratio of 21 new common shares for every 100 existing common shares.

There will not be any changes in the savings shares.

Why is the reverse stock split operation being done?

The reduction in share capital is necessary as a result of the operating losses taking place in 2021, which caused an erosion by more than one third of Saipem’s share capital.

The reduction of the share capital makes the reverse stock split necessary in order to maintain the same implicit accounting parity of common shares and savings shares (taking into account that the latter are deferred into losses pursuant to Article 6 of the Articles of Association).

In view of the reduction of the share capital, the number of common shares will be reduced by a total of 798,663,813 shares (of which 798,663,772 shares due to the merging of common shares and 41 shares due to the cancellation of treasury shares held by the Company), without indication of the par value.

Saipem’s subscribed and paid up share capital will therefore be €460,208,914.80, divided into 212,303,028 common shares (equal to 1,010,966,841 shares before the reverse split) and 10,598 savings shares (unchanged compared to the situation before the reverse split), all without indication of the par value.

The operation will include the cancellation of 41 treasury shares held by Saipem to allow the overall balancing of the reverse split operation. In the same context and merely for balancing purposes, profits of €10,250,383.50 will be carried forward.

I am a shareholder with a number of common shares that is a multiple of 100. What must I do?

Nothing. The existing common shares are merged into new common shares at the ratio of 21 new common shares for every 100 existing common shares.

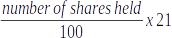

To calculate the number of common shares that will be held after the reverse split, simply apply the following formula:

Example: before the reverse split I own 300 common shares; following the reverse split, I will own 63 new common shares:

I am a shareholder with a number of common shares that is not a multiple of 100 and is greater than 5. What must I do?

Nothing. The existing common shares are merged into new common shares at the ratio of 21 new common shares for every 100 existing common shares.

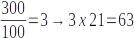

To calculate the number of common shares that will be held after the reverse split, simply apply the following formula:

After the reverse split, you will get a number of new shares equal to the result of the calculation rounded down to the nearest whole number.

The value of the remaining fraction will be paid in proportion to the official price of Saipem common shares recorded on May 20, 2022, the last trading day prior to the actual date of the reverse split, multiplied by the inverse of the reverse split ratio (the “exchange value”).

Example: before the reverse split I own 248 common shares:

following the reverse split, I will have 52 new common shares and my depositary broker will pay the exchange value of the remaining 0.08 new shares into my stock purchase account.

I am a shareholder with a number of common shares that is not a multiple of 100 and is less than 5. What must I do?

Given that the number of shares held before the reverse split would not allow you to receive any new shares, after the reverse split one of the following options may be chosen:

-

make a request by contacting your depositary broker for the payment of the exchange value, or;

-

make a request by contacting your depositary broker of the missing fraction to obtain one additional share between May 23 and May 27, 2022 at the cost of the exchange value, subject to availability.

Example: before the reverse stock split I own 4 common shares:

following the reverse split, I will not receive new shares, and:

-

the depositary broker may be requested to pay and credit the exchange value of the remaining 0.84 new shares to my stock purchase account;

-

the depositary may be asked to purchase the complement of 1 equal to 0.16 new shares at the cost of the exchange value, which will allow me to obtain one new share, subject to availability.

Will the overall market value of my investment in Saipem change because of this reverse split?

The reverse stock split will not have a direct impact on the investment’s market value, as the reduction in the number of shares will be offset by an increase in the price, according to the same inverse multiplier.

Furthermore, in the event of the payment for fractions, the economic value of these fractions will be transferred to the shareholder’s current account, keeping the overall market value of the investment unchanged.

The share price and, consequently, the overall market value of the investment, will in any case remain exposed to the dynamics and risks of the stock market.

What is the cost of this operation for the shareholder?

The operation will have no costs, taxes or fees for the shareholder.

pdf - 02-2023

pdf - 02-2023

pdf - 02-2023

pdf - 02-2023

pdf - 02-2023

Reverse Stock Split June 2022

Frequently Asked Questions

What was the reverse stock split operation?

On June 13, 2022, Saipem’s common and savings shares were merged together in the ratio of 1new share for every 10 existing shares.

Why is the reverse stock split operation being done?

The reverse stock split will take place in execution of the Saipem shareholders’ resolution of May 17, 2022.

The reverse split operation is being done to reduce the number of outstanding shares in anticipation of the share capital increase subject to approval by the aforementioned shareholders’ meeting, and therefore to simplify the management of the capital increase, and at the same time improve the perception of the share on the market in consideration of the effects of the reverse stock split on the unit stock price of the shares.

This further reverse split operation is not connected to the one that became effective on May 23, 2022, which was done solely for common shares as a result of the operating losses recorded in 2021, which led to a more than one third erosion of Saipem’s share capital.

Does the reverse split bring about a change in the company’s share capital?

No. Following the reverse split, Saipem's share capital remains unchanged at €460,208,914.80, divided into 21,230,302 common shares (equal to 212,303,028 before the reverse split) and 1,059 savings shares (equal to 10,598 before the reverse split), all without indication of the par value.

The operation will include the cancellation of 8 ordinary shares held by Saipem and 8 savings shares to allow the overall balancing of the reverse split operation.

I am a shareholder with a number of common or savings shares that is a multiple of 10. What must I do?

Nothing. The existing common and savings shares are merged into new shares at the ratio of 1 new share for every 10 existing shares.

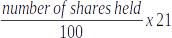

To calculate the number of shares that will be held after the reverse split, simply apply the following formula:

Example: before the reverse split I own 300 shares; following the reverse split, I will own 30 new shares:

I am a shareholder with a number of common or savings shares that is not a multiple of 10 and is greater than 10. What must I do?

Nothing. The existing shares are merged into new shares at the ratio of 1 new share for every 10 existing shares.

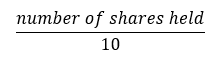

To calculate the number of shares that will be held after the reverse split, simply apply the following formula:

After the reverse split, you will get a number of new shares equal to the result of the calculation rounded down to the nearest whole number.

The value of the remaining fraction will be paid: for common shares, in proportion to the official price of Saipem common shares recorded on June 10, 2022, the last trading day prior to the effective date of the reverse split, and for savings shares, in proportion to the last official price of savings shares available on the same date, multiplied by the inverse of the reverse split ratio (the “exchange value”).

Example: before the reverse split I own 248 common shares:

following the reverse split, I will have 24 new common shares and my depositary broker will pay the exchange value of the remaining 0.8 new shares into my stock purchase account.

I am a shareholder with less than 10 common or savings shares. What must I do?

Given that the number of shares held before the reverse split would not allow you to receive any new shares, after the reverse split one of the following options may be chosen:

-

make a request by contacting your depositary broker for the payment of the exchange value, or;

-

make a request by contacting your depositary broker of the missing fraction to obtain one additional share between June 13 and June 17, 2022 at the cost of the exchange value, subject to availability.

Example: before the reverse stock split I own 4 shares:

following the reverse split, I will not receive new shares, and:

-

the depositary broker may be requested to pay and credit the exchange value of the remaining 0.4 new shares to my stock purchase account;

-

the depositary may be asked to purchase the complement of 1 equal to 0.6 new shares at the cost of the exchange value, which will allow me to obtain one new share, subject to availability.

Will the overall market value of my investment in Saipem change because of this reverse split?

The reverse stock split will not have a direct impact on the investment’s market value, as the reduction in the number of shares will be offset by an increase in the price, according to the same inverse multiplier.

Furthermore, in the event of the payment for fractions, the economic value of these fractions will be transferred to the shareholder’s current account, keeping the overall market value of the investment unchanged.

The share price and, consequently, the overall market value of the investment, will in any case remain exposed to the dynamics and risks of the stock market.

What is the cost of this operation for the shareholder?

The operation will have no costs, taxes or fees for the shareholder.

pdf - 02-2023

pdf - 02-2023

pdf - 02-2023

pdf - 02-2023

pdf - 02-2023

pdf - 02-2023

pdf - 02-2023