Events and fairs

OTC 2024 - Offshore Technology Conference

- 06 - 09/05/2024 - Houston, Texas, USA

Discover more

Engineering for a sustainable future

2,519

Patents and active patent applications

77%

No oil projects backlog

2050

Net zero for scope 1, 2 and 3

71€ MIO

Total expenditure on innovation

Header

Introducing Bluenzyme200™, the new solution by Saipem for carbon capture.

Text

The innovative plug&play solution devoloped by Saipem engineers to sustainably speed up the path towards net zero. Easy to install, efficient and sustainable

Image

Image

Image

Image

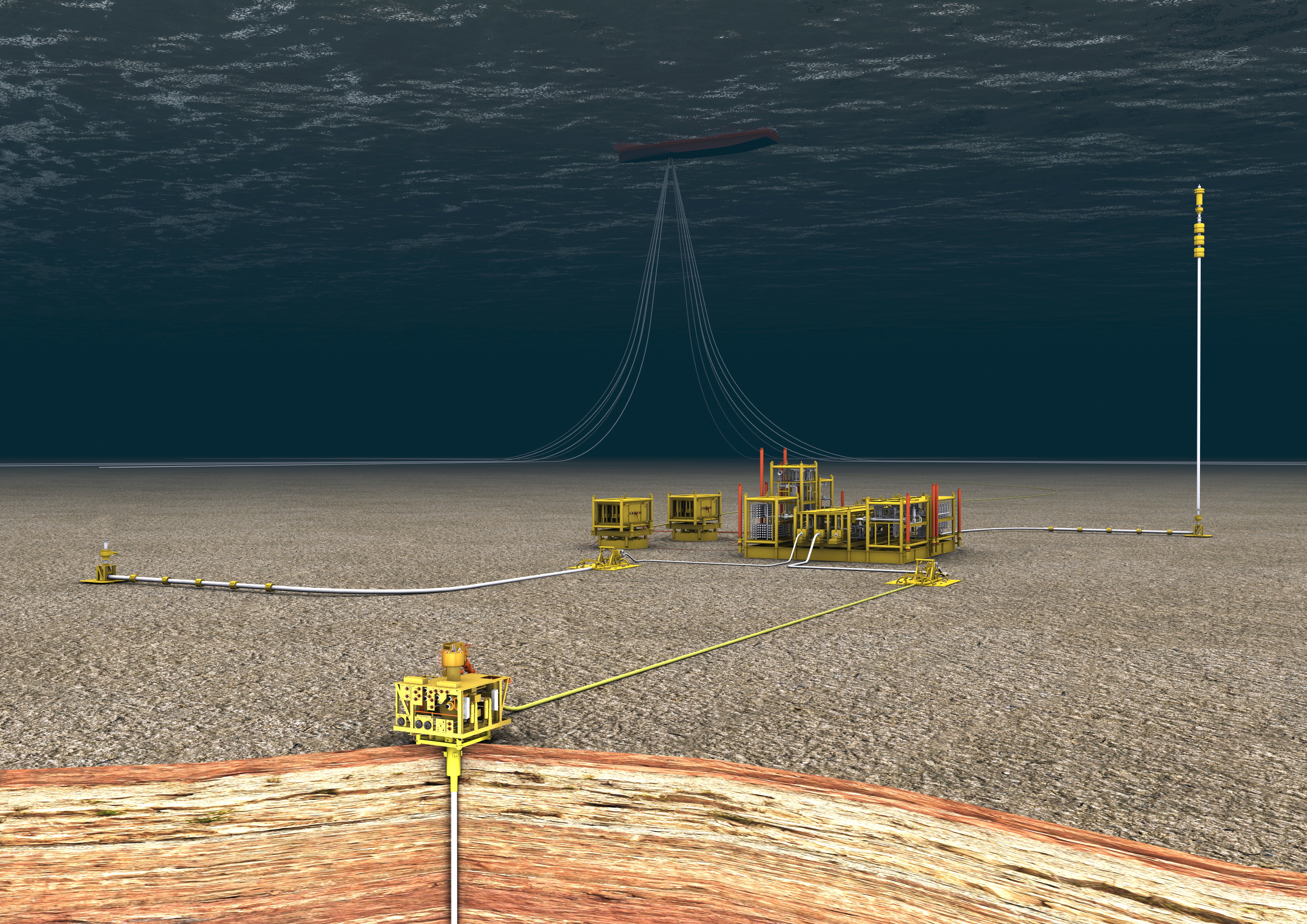

Floating High Tech

A vast mix of engineering specialists and project delivery services for various floating solutions.

Image

Fabrication Yard

Saipem's Fabrication Yards are located in key areas for the industry.

Image

Image

Image

Image

Image

Gas monetisation

Proven experience in technologies to take full advantage of natural gas.

Image

Image

Conventional Onshore

The right partner on land to guarantee a successful project with innovative, original solution.

Image

Image

CCUS - Carbon Capture Utilization and Storage

Our benchmarks in the CO₂ management chain.

Image

Image

Image

Image

Image

Image

Railways serving installations

We transform needs of stakeholders into services and customizable, safe and sustainable products

Sustainability

Sustainability

Our commitment is to generate sustainable value for all our stakeholders, integrating environmental, social and governance

People

Diversity & Inclusion

Saipem believes in people's value, backgrounds, their leadership styles and conduct, because each individual has the potential to generate value for our company.

Image

Image

Image

Discover how Saipem has always been engineering for a sustainable future.

Through history to today. And beyond.